Xiao Gu (pseudonym), a 24-year-old Changsha girl, has become popular on Xiaohongshu recently because she released a “4500-day retirement countdown calendar” and shared in detail her early retirement plan and her usual financial management skills. She hopes to save enough of the target amount of 2 million yuan and live a life of living everywhere in the future. This series of posts has been popular among netizens, and many people find it interesting, but many people question the feasibility of the plan.

Target: Retirement in 4500 days is less than 40 years old

Xiao Gu released this “4500-day countdown retirement calendar” on March 13, “In order to objectively understand my distance from early retirement fir<a How far is Babaylane? I made a 4500-day retirement countdown calendar. I read that right. The whole 4500 days, which is half of me, has been cut in total. I have cut 4500 small grids for a total of 4500 pieces. I have been doing it for a week. The countdown starts after more than 4000 days. Some people may feel bored, but for me, at least the pace of time is moving forward, and I am constantly moving towards the life I want. “

On the evening of March 17, the reporter contacted Xiao Gu. According to her, she is a native of Changsha and is 24 years old this year. Why do you have the idea of retirement early at such a young age? She said: “About 2 years ago, I accidentally learned about the fire group. Their concept of saving money first and enjoying it later is very attractive to me. I also joined the ‘fire life’ group on Douban. There are more than 220,000 members. Everyone usually communicates with various skills to increase revenue and reduce expenditure. The real decision to count down 4,500 days for retirement was not long ago. I calculated that it would take nearly 13 years to save enough money to save up to 2 million yuan. At that time, I was 3Babaylan. In order to motivate and remind myself, I made this countdown date. href=”https://comicmov.com/”>KomiksCalendar.”

Xiao Gu said that fire does not mean the English word “fire”, but FiBabaylannancial independence Retire early four abbreviations of the first letter of the English word, meaning “financial independence, retire early”. This group pursues the concept of “save money first, enjoy it later”, by reducing material desires and living a minimalist life, Cinema uses investment income to cover daily expenses, so that they have the confidence to pursue Cinema href=”https://comicmov.com/”>Babaylan‘s lifestyle I like, “I’m not rejecting work, but I don’t like the constant work. I want to freely control my life and dominate my time. Even if you retire early in 4500 days, it doesn’t mean you’re completely out of work. You may set up a stall or write articles, just like a travel blogger. ”

Advocating minimalism: no luxury goods, no mobile phones have been replaced for many years

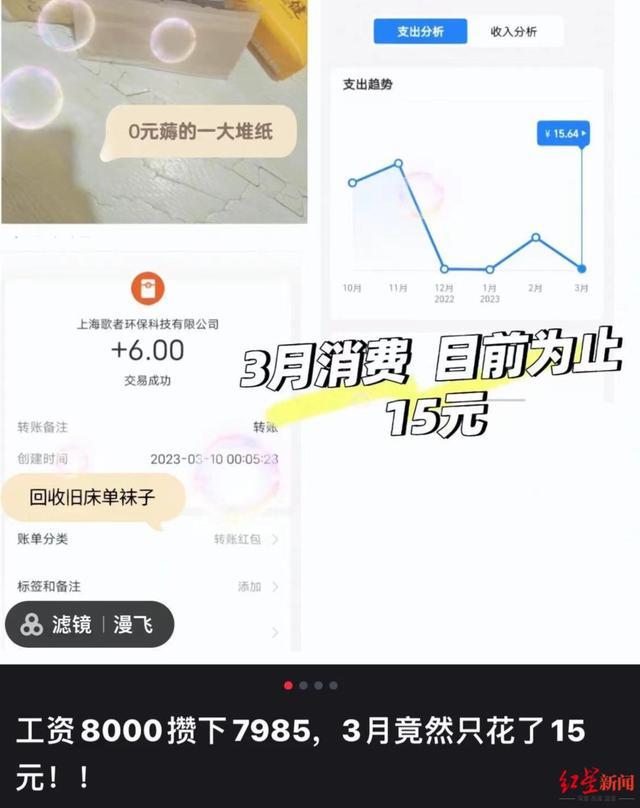

I also shared many posts on Xiaogu’s social platform on her own. For example, a post shared on March 15 called “Salary of 8,000Komiks is 7985, but it only cost 15 yuan in March”. This post records in detail how Xiaogu did it until only spent 15 yuan in March: living in, there is no mortgage on the house, and the water and electricity boyfriend paid for it, so there is no money; mobile phone bills and transportation fees, which are almost the same as her monthly management. href=”https://comicmov.com/”>Komiks‘s financial income is just about to be equal; eating, drinking, breakfast and lunch are solved by the company, free. Dinner is a few days for 0 yuan to eat snail noodles, the only expense is that I bought 15 yuan ingredients for shopping in the supermarket and ate it for several nights; daily necessities, Babaylan tissue paper cup washing handsBabaylan liquid garbage bags and toothpaste are basically obtained by wool; skin care products and cosmetics are purchased at one time every year on Double Eleven, and there is no need to buy them at other times. In addition, she hung all the idle clothes on salted fish, and the bed sheets and a skirt sold a total of 116 yuan. In this way, she not only did not spend money in the first half of March, but also made more than 100 yuan.p>

On March 16, Xiaogu posted a day’s consumption account: today’s interest income is 10 yuan, and it costs 2.28 yuan. Her breakfast and lunch that day were also settled at the company. The dinner was a pack of old Beijing instant noodles, plus a fried egg, a small bag of French fries, three big white rabbit milk candy, a cup of milk tea and a piece of pineapple. Netizens sighed, “You are really a good expert in saving money”, “This noodles look delicious”… Some netizens also commented under Xiaogu’s post: “This is financially free”, “I hope to share some tips on saving money in the future”, etc.

Xiao Gu said that he now advocates minimalism, and Cinema usually consumes very lowly, and he will not make any risky investments. “I don’t have any luxury goods or some expensive electronic products. I have used more than 2,000 yuan for a mobile phone for two or three years.”

In addition to getting a salary at work, Xiaogu also showed off his investment and financial management plan, including the funds he purchased. She said that her total assets are currently 656,000 yuan, completing 32.8% of the progress. With her parents’ sponsorship, she spent 500,000 yuan to buy an apartment in Changsha, with a monthly rental income of 2,600 yuan, which can be regarded as a long-term income financial product. The remaining 156,000 yuan was all bought in a stable bond fund.

Family: Parents want stability, and their boyfriends also join the plan

What do parents think about their plan to retire early?

The reporter called Cinema to visit Xiao Gu, her mother was next to her. “The parents were very opposed at first because it was difficult to KomiksI was asked to go to work, but I had to retire early. Anyway, in their hearts, they just feel that it is only stable to go to work. The reason why I tried to save this money was not only to give them an explanation, but also to give myself a sense of security. I divided my life into the first half and the second half. The first half was for the people around me, and I had to live for myself in the second half. “

Xiao Gu said: “My boyfriend was also a traditional office worker at the beginning, and he wanted to work diligently until he was old. But after carefully studying my plan, I felt that the plan was very detailed and solid, not unrealistic. Finally, he was moved by me and joined in. Now we both have more common languages. He now has a similar plan to countdown on retirement. ”

Source | Yangcheng Evening News • Yangcheng School Comprehensive Upstream News, Red Star News, Western Decision-making BabaylanD Video and other editor | Zheng Zongmin